|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

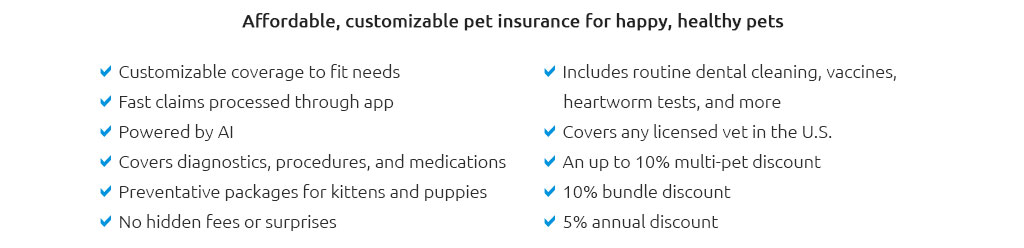

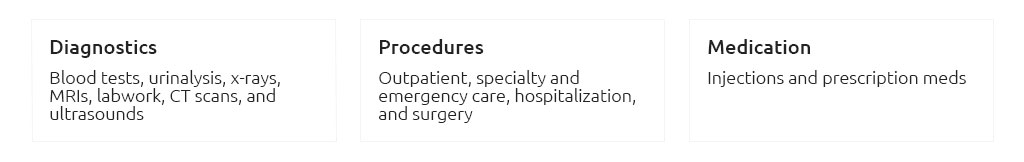

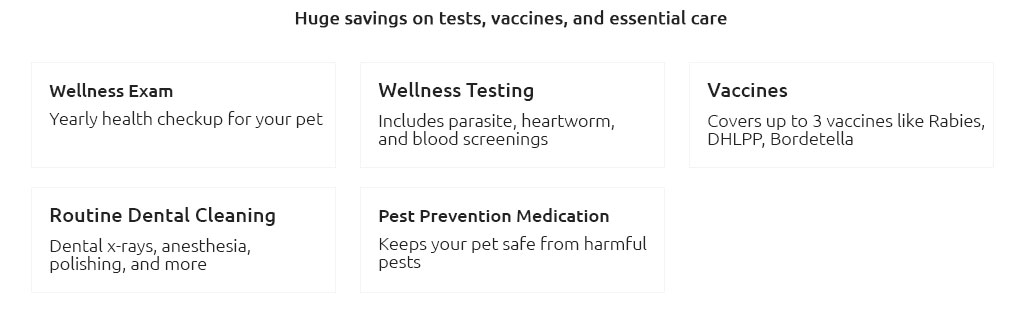

Health Insurance for My Cat: Navigating Available OptionsIn the ever-evolving world of pet care, the question of whether to invest in health insurance for your cat is becoming increasingly relevant. As a devoted pet owner, you want to ensure your feline companion receives the best care possible without breaking the bank. This article delves into the intricacies of cat health insurance, offering a comprehensive look at what you can expect when navigating the available options. First and foremost, let's address the fundamental question: why consider health insurance for your cat? Much like humans, cats can experience unexpected health issues, ranging from minor ailments to serious conditions requiring extensive medical treatment. Veterinary bills can quickly accumulate, especially if your cat needs surgery or ongoing medication. Health insurance can provide peace of mind, allowing you to focus on your cat's well-being rather than the financial implications of their care. When exploring health insurance options, it's essential to consider the coverage each plan offers. Policies can vary significantly, so take the time to understand what is included and what isn't. Some plans cover accidents and illnesses, while others may offer more comprehensive coverage that includes routine check-ups, vaccinations, and preventive care. Be sure to read the fine print and ask questions about any limitations or exclusions that could affect your cat's coverage. Another critical factor is the cost of the insurance premiums. Premiums can vary based on factors such as your cat's age, breed, and health history. While it may be tempting to opt for a cheaper plan, it's important to balance cost with coverage. A plan with lower premiums might not provide adequate protection when you need it most. Consider your budget and your cat's specific needs when selecting a plan. Customer reviews and ratings can also be invaluable resources when evaluating different insurance providers. Hearing from other cat owners about their experiences can offer insights into the reliability and responsiveness of a company. Look for providers with a strong reputation for customer service and claims processing efficiency. Lastly, consider the flexibility of the insurance plan. Some policies allow you to choose your veterinarian, while others may require you to use a network of approved providers. Additionally, check whether the plan offers customizable options, allowing you to tailor the coverage to suit your cat's unique needs. In conclusion, health insurance for your cat is an investment in their health and your peace of mind. By carefully assessing the coverage, cost, customer feedback, and flexibility of available options, you can make an informed decision that best supports your feline friend's well-being. FAQWhat factors should I consider when choosing health insurance for my cat?Consider the coverage options, cost of premiums, customer reviews, flexibility of the plan, and whether you can choose your veterinarian. Is health insurance necessary for a young and healthy cat?While a young and healthy cat may not require immediate coverage, having insurance can protect against unexpected accidents or illnesses in the future. Can I use any veterinarian with my cat's health insurance plan?This depends on the plan; some allow you to choose any veterinarian, while others may require you to use a network of approved providers. What are common exclusions in cat health insurance policies?Common exclusions can include pre-existing conditions, elective procedures, and certain breeds' hereditary conditions. https://www.metlifepetinsurance.com/

I highly recommend MetLife Pet. "We adopted two cats after being pawless for a couple ... https://www.pawlicy.com/blog/why-does-my-cat-need-pet-insurance/

There are three types of insurance plans for cats, each with different degrees of coverage: accident-only, accident/illness, and wellness plans. Accident-Only ... https://www.embracepetinsurance.com/cat-insurance

Providing insurance for your cat is the best way to protect them from unexpected illnesses or accidents.

|